The future of banking awaits.

You've had enough of implementations taking forever, often with unknown outcomes? Meet Fintense, a ready-made solution based on great experience, automation and best practices on the market. Launch your bank into the future, today!

Download product brochureWhat is Fintense?

Fintense is a ready-made digital banking platform supporting banks looking for fast transformation into digital leaders.

End-2-End Customer Facing Processes

Created from the ground up and based on extensive experience and best practices in the fintech industry, Fintense digitizes End-2-End customer facing processes, helping banks to increase their efficiency and focus on customer needs.

Easy Cloud-Based Implementation

Completely cloud-based and easy to implement, Fintense digital banking platform enables you to interact with your customers on any digital channel.

Unique Opti-Channel Journey

Aimed at banks who want to make a step forward, Fintense optimizes your channels and lets you and your customers experience a unique opti-channel journey.

Quick-Win Solution

Featuring state-of-the-art design and user experience, Fintense is a fast, quick-win solution, offering lightning speed time to market and potential for strategic development.

Watch our video introduction

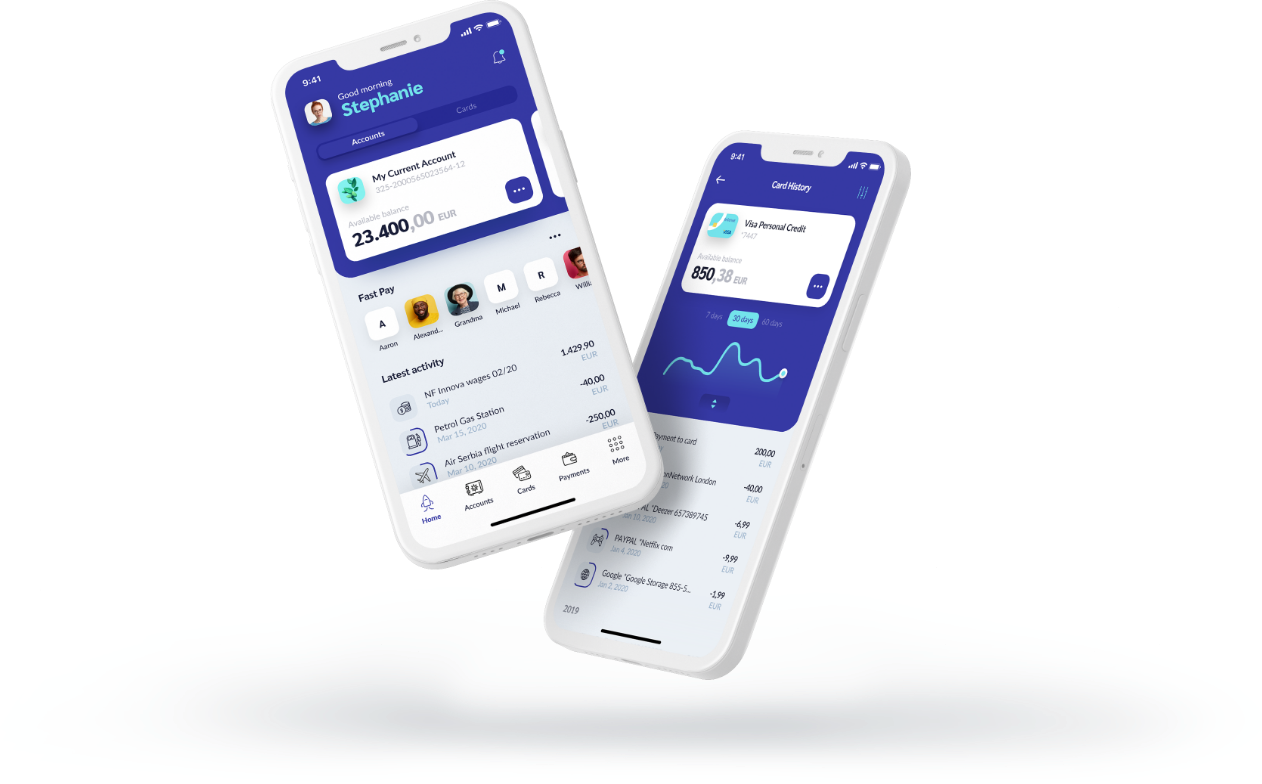

Full retail/individual banking services

Fintense offers a wide variety of retail and individual banking services, letting customers take their finances and banking with them, wherever they go and no matter where they are.

Read moreFull retail/individual banking services

Fintense offers a wide variety of retail and individual banking services, letting customers take their finances and banking with them, wherever they go and no matter where they are. Thanks to a full set of banking services, your customers will enjoy a premium banking experience.

- Accounts and cards overview: balances, details, transaction history, statements, graphs

- Internal transfers between customer's accounts

- Domestic and international transfers

- Saved/predefined payment beneficiaries

- Currency exchange

- Peer-to-peer payments: transfers between individuals

- QR code payments

Online account opening

Customers can sign up online in real-time, without visiting a branch or talking to the call center. Fintense features a simple integration and orchestration of external systems.

Read moreOnline account opening

Customers can sign up online in real-time, without visiting a branch or talking to the call center. Fintense features an optichannel customer enrollment process – start on web, finish on mobile.

- ID scan & face recognition

- Based on End-2-End automation of customer facing processes

- KYC and AML processes included

- Digital signature available

- Document storage

- Simple integration and orchestration of external systems

Opti-channel platform

Single-point administration for all digital channels, including web, mobile, smartwatch, kiosk etc. Infrastructure is shared among all channels, including the integration and data layers.

Read moreOpti-channel platform

Single-point administration for all digital channels, including web,

mobile, smartwatch, kiosk etc. Infrastructure is shared among all

channels, including the integration and data layers.

The back-end infrastructure is shared among all channels, including

the integration and data layers. All actions performed on a channel

are immediately visible and accessible on all other channels – for

example, switching to another channel in the middle of a loan application

is completely seamless.

Online loans for clients and non-clients

Customers can apply for loans without visiting the bank branch. A modern, easy to understand user experience leads them through the process featuring KYC or video call identification.

Read moreOnline loans for clients and non-clients

Online banking solution is built with full customizability in mind.

Existing functionalities can be extensively customized, both by the

vendor and by the bank, using iBanking SDK.

In contrast to standard native mobile apps which require users to

download updates after any modifications, no matter how small,

Fintense supports extensive customization and (re)organization

without the need for submitting updates to app stores.

The Bank can change both the design and the user experience using

visual tools, and such changes can be live and accessible to app

users immediately, without waiting for the app update to be accepted

and published.

Personal finance management

Built-in personal finance management module automatically categorizes all the customers' incomes and expenses from their accounts or cards, based on the descriptions of the transactions and merchant categories.

Read morePersonal finance management

Built-in personal finance management module automatically categorizes

all the customers' incomes and expenses from their accounts or cards,

based on the descriptions of the transactions and merchant categories.

The categorization of the transactions is done on multiple levels:

- Automatically, using the default system rules applicable to all customers

- Automatically, using the personal rules of each customer (which override the system rules)

- Manually, by changing the category, if needed

The module also supports budgeting per month per category and automatic tracking of the expenses in those categories, including the overspending alerts.

Cloud deployment

Fintense offers full-service approach, by taking care of infrastructure and maintenance. New features are being continiously added through regular platform upgrades.

Read moreCloud deployment

Fintense offers full-service approach, by taking care of infrastructure and maintenance.

New features are being continiously added through regular platform upgrades.

Major cloud hosting platforms, like Amazon AWS

and Microsoft Azure are supported, as well

as deployment in private datacenters.

Get Fintense

Want to explore your options and see how Fintense can help your bank?

Contact us and you're one step closer to modern banking.

Modern user experience

Good user experience equals satisfied customers. Fintense gives your customers a modern online banking user experience, easy to use with a design that follows the latest trends in mobile UI design and development.

Quick solution and short time to market

Fintense is a complete digital banking platform, built using the best

practices in cooperation with banks across the world.

Fast implementation significantly shortens time-to-market, while at

the same time offering a cloud-based solution that can be configured

to suit your bank’s needs.

Let's work together...

Become a part of fast-moving world of fintech and get ahead of your competition.

Please fill out the form with your contact information and we'll take it from there! Our team of experts will contact you and set up a meeting or answer any questions you might have. Make the first step, the future of banking awaits!